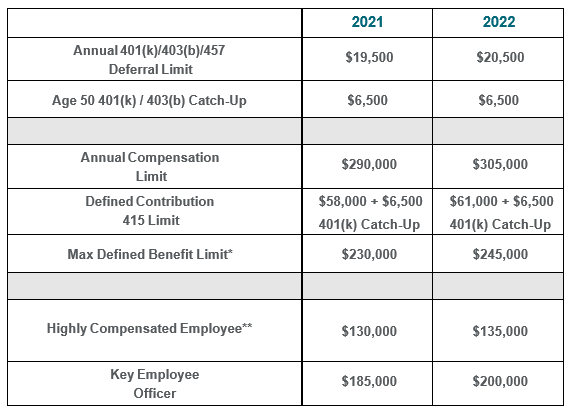

The IRS released Notice 2021-61 on November 4, 2021 disclosing the cost-of-living adjustments for retirement plans. Many of the limits increased for 2022 as compared to 2021. The most notable increases that are effective January 1, 2022 are listed below. Plan sponsors should ensure their payroll system is updated and the new limits are being used for any Plan related calculations or contributions.

Below is a condensed version for quick reference for some of the limits. Click here to access a PDF of our complete chart with the 2022 limits in addition to the 2021 and 2020 limits for comparison.

If you have additional questions or would like to discuss your retirement plan, please reach out to our Retirement Plan Services Team.