Very few Virginia nonprofits rely solely on donor generosity to stay afloat, but for many, a large portion of their annual revenue can be credited to donor contributions. It is essential nonprofit leaders understand how to account for these contributions, especially considering reporting standards changes we have seen in recent years.

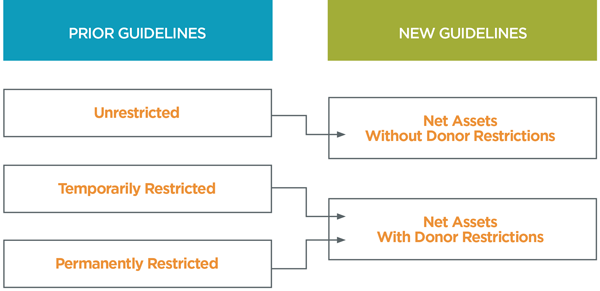

With the passage of Accounting Standards Update 2016-14 (ASU 2016-14), which went into effect in 2018, nonprofits are required to organize their contributions into one of two categories: assets without donor restrictions or assets with donor restrictions. Whether contributions are temporarily or permanently restricted continues to be relevant to the financials, but that information has been moved from the statement of financial position to the footnotes. We discussed the basics of accounting for contributions in a previous article, but today we would like to dig a bit deeper and discuss how contributions are recorded when their restrictions are released.

Overview of Accounting Changes

Prior accounting standards segregated temporarily and permanently restricted contributions on the statement of financial position. Today, they are consolidated to report all restricted assets, regardless of their permanency.

While it’s true all donor-restricted contributions will be recorded in the same section of the statement of financial position, it does not mean accounting for those restrictions will be simple.

Accounting for Donor-Restricted Contributions

Individuals can place temporary or permanent restrictions on any donation they make. A permanently restricted donation would be recorded to assets with donor restrictions in perpetuity. Permanently restricted assets are also often referred to as endowments or scholarship funds, and their purpose is to provide the nonprofit with a pool of money that will generate investment income. Nonprofits are free to use that investment income as they please, but they cannot use the principal balance of the donation – ever. That means that permanently restricted assets will remain in the assets with donor restrictions category forever.

Temporarily restricted contributions are also recorded in assets with donor restrictions but will, in time, be moved to net assets without donor restrictions. When their restrictions have been released or the stipulation has been met, those funds will shift. This means that nonprofits must track progress toward fulfillment of the donor’s request. A donor may, for instance, request that their funds be kept as an investment for the next ten years. The nonprofit must track how long those funds have been held so that, after the ten-year period has passed, they can transfer those assets over to the assets without donor restrictions section of the financials and use those funds freely.

Practical Advice

Keeping track of donor restrictions can be quite burdensome, so many nonprofits solicit unrestricted donations whenever possible. To ensure their donations will be unrestricted, they must be careful when drafting their fundraising requests. If the language in the solicitation letter discusses only one of the organization’s programs, the nonprofit may be inadvertently soliciting restricted donations. The letters should clearly state that the donations will be used for any existing or future programs.

When donations are restricted, nonprofits must keep records that show donors’ intents and then regularly review those records to track progress toward the release of those restrictions. Some organizations use simple spreadsheets to track these gifts, but others will need a more robust general ledger that can do some of the work for them.

No matter what, all staff members should be trained in how to record restricted donations. They should also be told why doing so is important. Having a written policy that explains how gifts should be documented will help. Nonprofits can also make their jobs easier by keeping in regular contact with their donors; they may need to contact donors to discuss their restrictions.

Contact Us

Donor-restricted funds will look different on this year’s statement of financial position, but in practice, not much has changed from a day-to-day accounting perspective. Nonprofits must keep track of permanently and temporarily restricted assets; they must still track progress toward release of those restrictions; and they must still be careful and intentional when soliciting restricted or unrestricted donations. If you have any further questions about donor-restricted contributions, or about other reporting changes you might be facing as a nonprofit, contact PBMares today. We look forward to hearing from you soon.