The government’s current small business initiatives are requiring contractors to have an adequate cost accounting system capable of recording contract costs in accordance with the requirements established in the Federal Acquisition Regulation (FAR). The SF1408, Preaward Survey of Prospective Contractor (Accounting System) details some sixteen specific requirements a potential contractor must meet for their accounting system to be considered adequate.

To simplify this list of basic requirements and make compliance more understandable and attainable for small contractors, we’ve compiled the following five capabilities contractors should implement and document in written policies and procedures.

Capability Requirement #1 – Organized Chart of Accounts

Regardless of the accounting process being utilized, manual or electronic, you need to set-up your chart of accounts identifying both your direct contract costs and your indirect costs not identifiable to any one final cost objective to facilitate construction and analysis of your indirect rate calculation. As an example, direct and indirect labor costs should be recorded in accounts that can be reconciled to the amount of your payroll for the same time period. As an example, fringe benefit costs should be recorded in accounts that can be related to the total direct and indirect labor during the same period to facilitate calculation of a fringe benefit rate. The same should be done for any other indirect rate needed to accurately assign your indirect costs.

As an example, your Chart of Accounts might look like this!

- 5000 = Direct Labor

- 5100 = Direct Materials

- 5200 = Major Subs (Direct)

- 5300 = Other Direct Costs (i.e. Travel)

- 6000 = Fringe Benefit

- 7000 = Overhead

- 7100 = Material Handling Indirect

- 7200 = Major Subcontract Indirect

- 8000 = G&A

- 9000 = Unallowable Costs

Capability Requirement #2 – Labor Collection – Total-Time Accounting

Labor is one of the biggest, if not the biggest, cost you will incur. It can be direct, incurred in the performance of your contracts, or indirect, incurred in support of your contractual efforts or in the running of your business. You need to establish a labor collection process that collects and records every minute of time expended by you and your salary employees for which you or they are paid. This includes all productive and non-productive time and appropriate accounts should be set-up in your accounting system (i.e. chart of accounts) to collect these labor costs as they are incurred.

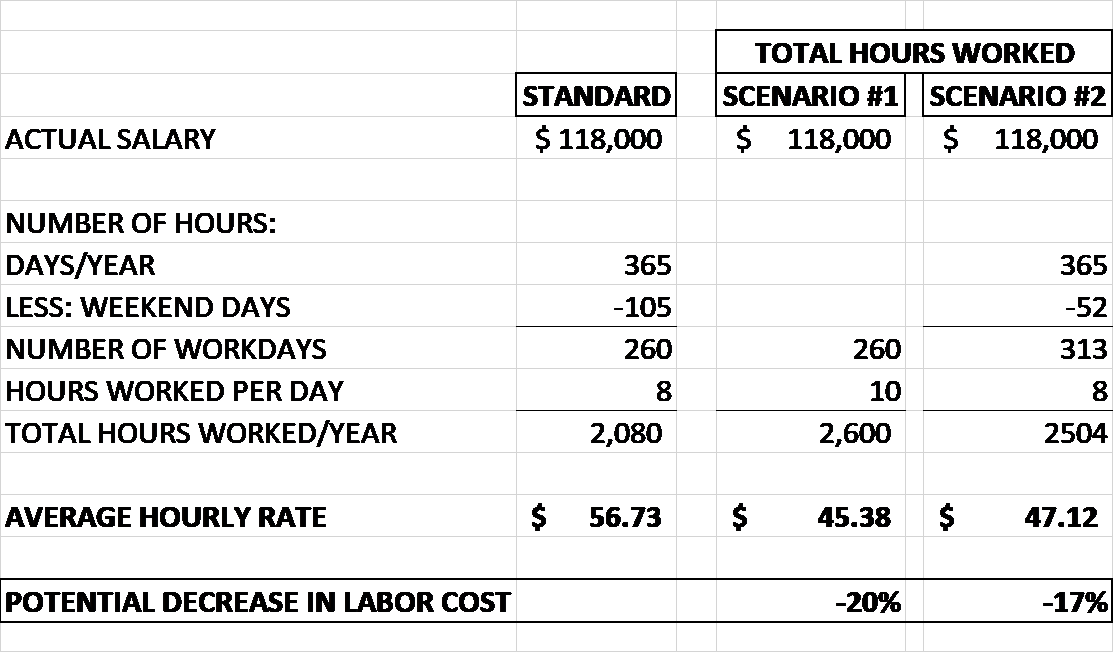

It is important to understand that with total-time accounting, while the amount of salary paid each pay period will remain the same, the effective rate per hour will vary dependent on the number of hours worked during the pay period. This process of calculating an effective hourly rate based on the total hours worked only applies to salary employees since hourly employees are paid for each hour worked at the same rate per hour.

As you can see, the use and projection of an effective hourly rate can be strategically beneficial when used in developing your pricing.

Capability Requirement #3 – Job Cost Accounting

Contracts that are proposed and invoiced based on the incurrence of actual costs require Identifying and accumulating all efforts including direct labor, direct material, direct subcontracts and other direct costs (ODC) by assigned charge numbers associated with each contract, task order and CLIN. These direct costs must be accounted for accumulated and reported in the same, or greater, detail than proposed allowing the government the ability to match proposed vs. actual costs.

Capability Requirement #4 – Indirect Rate Development

The allocation of indirect costs to contracts, task orders or CLIN’s and other established cost objectives is essential in determining what something costs, what its true price should be and whether you are attaining the profit objectives required.

Develop a strategic indirect rate structure that will equitably allocate all your indirect costs, collected in homogeneous cost pools, to your direct costs on a beneficial or causal relationship. To facilitate the calculation of these indirect rates all indirect costs should be recorded in specific accounts established in the general ledger.

Capability Requirements #5 – Unallowable Cost Identification, Segregation and Elimination

The government has determined that certain costs may be unallowable (read not payable by the government), that other costs are expressly unallowable, and situations where directly associated costs, normally allowable, are unallowable. Contractors must establish a process for the identification of these unallowable costs identified in FAR 31.205. Once identified these costs, whether direct costs or indirect costs, must be identified, either as incurred or after initial recording and before being billed, claimed or proposed. These costs need to be recorded in separate accounts set-up in the general ledger. They must be eliminated from direct or indirect costs billed, claimed or proposed to the government. Failure to eliminate these costs can result in financial penalties to the contractor.

Capability Summary

Establishing these five capabilities requires recognition of their importance while doing business with the federal government. They are really pretty simple, and you might be already well on your way to compliance. Once established, it is critical that the processes are documented in written policies and procedures to ensure continued compliance as your organization grows and personnel change and to facilitate an eventual government audit.

Have questions related to your specific situation? Contact Neena Shukla, CPA, CFE, CGMA, FCPA, CTP, Partner and Team Leader of PBMares’ Government Contracting Team.