Beneficial Ownership Information (BOI) Report

Notice: For the most up-to-date guidance and rules impacting your obligations, if any, to file a BOI Report, please visit the FinCEN website or consult with your PBMares Advisor.

Resources to Help You Navigate New FinCEN Requirements

Starting on January 1, 2024, millions of entities will be subject to new reporting requirements. The Beneficial Ownership Information (BOI) Report is a non-tax form that entities must file with the Department of Treasury’s Financial Crimes Enforcement Network, or FinCEN.

FinCEN enacted this new rule to combat money laundering and enhance national security by making it harder for criminals to hide behind anonymous shell companies. Unfortunately for many small business owners, that means increased reporting.

More than 6.6 million filings are expected in the first year.

This page contains helpful guidance and resources to help PBMares clients navigate this new requirement.

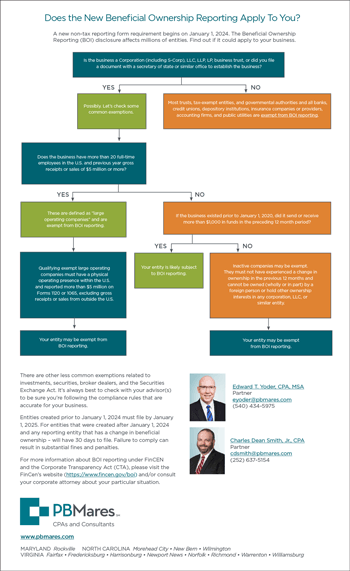

Does the New Beneficial Ownership Reporting Requirement Apply To You?

We created this flowchart to help you quickly review common exemptions to Beneficial Ownership Reporting. Please consult with your tax advisor before making a final determination.

Use these quick links to advance to each section below:

Background

Definitions

Timing and Next Steps

Beneficial Ownership Reporting By Industry

Construction

Outside Resources

Frequently Asked Questions – General

Background

Definitions

Timing and Next Steps

Beneficial Ownership Reporting By Industry

Outside Resources

If you want to learn more about Beneficial Ownership Reporting, these pages contain more details and information.

FinCEN: Beneficial Ownership Reporting

FinCEN Small Entity Compliance Guide

Does the New Beneficial Ownership Reporting Requirement Apply To You?

This flowchart quickly reviews common exemptions to Beneficial Ownership Reporting. Please consult with your tax advisor before making a final determination.

For more information about BOI reporting under FinCEN and the Corporate Transparency Act, contact:

Edward T. Yoder, CPA, MSA

Partner