Everyone knows the saying from Ben Franklin, “In this world nothing is certain but death and taxes”. At the same time, most of us have a goal of retiring someday, so doesn’t it make sense to consider strategies that minimize the taxability of your portfolio along the way? Below are a few ideas to think about when managing your portfolio in a tax-efficient manner. Best of all, these strategies don’t require you to have an advanced degree in portfolio management; investors at all levels can take advantage of them.

1) Minimize Dividends and Capital Gains: Dividends are typically paid by companies to shareholders based on how profitable they were during a recent time period. As an investor, you can receive qualified dividends (taxed at your capital gains tax bracket) and/or non-qualified dividends (taxed at your ordinary income tax bracket). In either situation, dividends are taxable to you, thus, the more you receive, the more you have to report to the IRS each year. If you are investing with Mutual Funds or Exchange Traded Funds (ETFs), then you will most likely pay taxes on the capital gain distributions from the funds at the end of each year as well. When investing with a taxable investment account, dividends and capital gains are taxable in the year received. If investing with a retirement account such as an Individual Retirement Account (IRA), then taxes are deferred until funds are distributed.

As your portfolio grows over time, you can have increasing amounts of dividends and capital gains that are taxable, but what can you do about it? One thing to consider is making sure that the fund you decide to use is tax conscious and purposefully minimizes the income it distributes.

2) Manage Trading Activity: When investors discuss recent stock market movements, what they are really talking about is something out of their control when considering how it affects their portfolios. What can you control that also has a significant impact on your portfolio over time? Your trading activity.

Say you wanted to sell your stock in ABC Company for $100 and you bought the stock for $80, meaning if you sold today, you would have a taxable gain of $20. If you originally purchased the stock within the last calendar year, the $20 gain would be taxed at the short-term capital gain rates (i.e. your ordinary income tax bracket). If you sold the stock after holding it for at least a year and one day, then the gain would be taxable at the long-term capital gains rates (which are usually lower). By minimizing your short-term taxable gains, you can lower the amount of taxes you pay and keep more of your investment’s growth.

Triggering short-term gains is an outcome typically associated with frequent trading, which is something investors can control, unlike broader stock market activity. Most people understand how compounding works when you save money over time. The same principle can be applied to the tax savings you can realize by managing the taxability of your trading activity. The amount of money saved each year by being a tax-conscious investor can add tremendous value to your portfolio over time.

3) Asset Location: When building a portfolio, some investors start this process by deciding how much of the portfolio they want invested in stocks and how much they want invested in bonds. A major role of stocks in a portfolio is to provide long-term growth while bonds are primarily there to provide stability in the event of negative stock market movements. Each have an important role to play, so is there an advantage to putting stocks in certain account types? What about bonds? This is the concept of asset location.

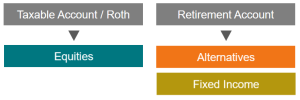

When you think about stocks, the primary goal is long-term growth to help fund retirement and other goals. The practice of asset location suggests that investors should try to allocate stocks to Roth IRAs or taxable investment accounts. With a Roth IRA, withdrawals are usually tax free, so if your stocks have grown significantly over time, you shouldn’t have to worry about tax consequences. With a taxable investment account, the taxable gains on an investment held for over a year are taxed at your capital gains tax bracket, which ideally should be lower than your ordinary income tax rate.

On the other hand, bonds aren’t known to provide significant growth over time; instead, one of their major roles is to act as a stabilizer in your portfolio. Because you don’t expect as much growth as you would with stocks, it makes sense to put bonds in retirement accounts such as an IRA. With these accounts, any money taken out is taxed at your ordinary income tax rates, which are typically higher than your capital gain tax rates. By having bonds (lower growth) being taxed at higher rates and stocks (higher growth) being taxed at lower capital gain rates or even tax free with a Roth IRA, you can optimize your portfolio for tax efficiency. The graphic below explains this concept.

4) Tax-loss Harvesting: Nobody likes a stock market downturn. However, there is a silver lining that can benefit you at tax time, which is known as tax-loss harvesting.

Say you bought $100 worth of Mutual Fund WXYZ, which invests in US technology stocks. The fund has experienced losses recently as the economy entered into a recession, and today, it is worth $60. The dilemma investors like you now face is that you chose this investment for a reason and don’t want to replace it, yet you have a big loss on paper. By utilizing tax-loss harvesting, you could sell your WXYZ Mutual Fund shares for $60 and reinvest the proceeds into another US technology fund. However, the IRS does stipulate that you cannot purchase a “significantly identical” investment within 30 days in order to keep the loss. The result is that you can capture the $40 loss on paper, which can lower your taxable income in the current year and potentially future years, while still remaining allocated towards US technology stocks like you wanted. You still have a loss relative to where you started ($100), but now you’ve captured a taxable loss that can provide at least some benefit.

At the end of the day, many financial decisions are inherently tax decisions as well; there is almost always a tax impact. Incorporating some of the above strategies can help you manage your tax exposure when it comes to managing your portfolio.

If you have any questions and/or would like to discuss these ideas further, contact us.

Author: PBMares Wealth Management