This article is Part One of a Series.

Retiring is one of the biggest life decisions an individual can make during their lifetime. It is also one of the most exciting. Most people view retirement as a financial decision, and that is true. However, it’s equally important to consider mental and physical health alongside financial health when planning to retire.

This two-part series explores common financial risks to consider before retiring. The next installment, Retirement Planning: Shifting Your Mindset from Saver to Spender, will focus on the importance of being mentally prepared for retirement, not just financially ready.

Key Takeaways:

- Build a realistic retirement budget.

- Plan for increased healthcare costs.

- Consider the timing options for claiming Social Security.

- Prepare for inflation with a long-term investment strategy.

- Create a withdrawal plan to increase financial efficiency.

Financial Considerations

Before deciding to retire, it’s essential to ensure financial readiness. There are several opportunities and risks to consider before retirement. The most common considerations include:

Planning Expenses

Before retiring, it’s essential to understand how much can be safely spent each year without depleting savings. A solid retirement budget is the foundation of financial peace of mind. With roughly 40 extra hours of free time each week, spending on hobbies, travel, or leisure activities may increase. That can be a positive part of retirement, as long as it algins with the financial plan.

It’s also important to plan for unexpected or irregular expenses. These might include home repairs, vehicle replacement, medical costs not covered by insurance, or more frequent vacations. These non-monthly costs can add up quickly if not accounted for.

Preparing for Healthcare Costs

Rising health care expenses are a major factor to consider in retirement. A few key facts highlight the importance of planning ahead:

- In 2024, a 65-year-old retiree can expect to spend an average of $165,000 on medical expenses throughout retirement.

- The average monthly premium for one person on an ACA health plan in 2024 is $477 without tax credits.

- Nearly 70% of people aged 65 and older will require long-term care at some point.

These figures highlight the importance of building health care costs into retirement planning.

Those planning to retire before age 65 will need to secure interim health insurance, typically through the Health Insurance Marketplace. This can be an added expense that wasn’t part of the budget during working years. Once eligible for Medicare at age 65, many retirees require a supplemental plan to help cover out-of-pocket costs.

Long-term care can be financially draining if not addressed in advance. It’s important to consider whether to self-insure or purchase long-term care insurance.

One option to prepare for future medical expenses is a Health Savings Account (HSA). If eligible, an HSA offers triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Choosing the Right Time to Claim Social Security

Another important decision in retirement planning is determining when to start receiving Social Security benefits. Consider the following facts:

- Claiming Social Security at age 62 typically results in a permanent 30% reduction in monthly benefits.

- Delaying benefits beyond full retirement age increases the monthly benefit by 8% per year, up to age 70.

- Starting Social Security before full retirement age and earning more than $23,400 in 2025 from wages or self-employment reduces benefits by $1 for every $2 earned over this limit.

- In the year full retirement age is reached, benefits are reduced by $1 for every $3 you earn over $62,160 in 2025.

Depending on your financial situation, Social Security may be a large part of retirement income. Since every situation is unique, it’s helpful to consider the following questions before electing to receive Social Security:

- What are the estimated benefits for an individual and spouse, if applicable?

- What is the planned retirement age?

- What is the life expectancy based on personal and family history?

- Is there flexibility to delay Social Security benefits in exchange for a higher monthly amount?

Understanding available options and identifying a strategy that aligns with long-term goals can help maximize benefits.

Protecting Purchasing Power

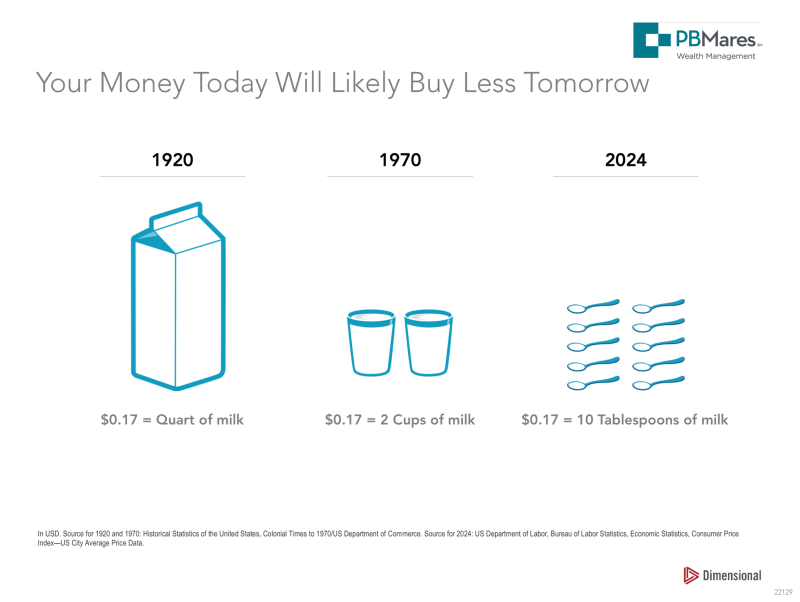

Inflation has been a hot topic in recent years, and it can have a meaningful impact on retirement planning. As inflation rises, it naturally decreases purchasing power. Take the cost of milk as an example:

Fighting the erosion of the dollar needs to start long before retirement, often through investments like stocks which have the potential to outpace rising costs. However, finding the right investment allocation depends on goals, timeline, and risk tolerance.

For those concerned about inflation, a comprehensive financial plan can help identify an ideal after-tax, inflation-adjusted retirement spending strategy.

Building a Smart Withdrawal Strategy

There are many factors in retirement outside of an individual’s control, such as health care costs, inflation, market performance, and changes in government policies. But, one area that can be managed is the retirement withdrawal strategy.

Most retirees have access to three types of accounts: tax-deferred, tax-free, and taxable. Deding how and when to pull money from each of these accounts can have a major impact on long-term finances. The following considerations can help form an effective withdrawal plan:

- Retiring before age 59 ½ may lead to an early withdrawal penalty of 10%, if funds are taken from 401(k), 403(b), 457, and IRAs.

- Roth Conversions are worth considering if there is an expected lower tax bracket.

- Required Minimum Distributions (RMDs) are required at a certain age, and early planning can help reduce the impact through strategies such as Roth Conversions, qualified charitable distributions, or liquidating from multiple tax buckets early on in retirement.

- While Roth conversions and qualified charitable distributions may help with save money on taxes, managing Medicare premiums is another strategy. This works by controlling the *IRMAA bracket.

*IRMMA stands for Income Related Monthly Adjustment Amount and determines what your Medicare premium will be.

An effective withdrawal strategy should be personalized and consider all aspects of life. Working with a trusted financial planner can walk you through the options and help create a plan.

Expect the Unexpected

Retiring at 65 means could mean living another 20-30 years—plenty of time for unexpected changes. Each of the risks mentioned above can be addressed through proactive planning. Focusing on being proactive, rather than reactive, helps alleviate stress and allows retirees to enjoy retirement to the fullest.

A key step in this process is finding a financial advisor who can walk through these potential challenges and help incorporate solutions into your retirement plan. Each element of retirement represents a puzzle piece, and a skilled financial planner can help bring these pieces together, ensuring a smooth and confident transition into retirement.

Learn More

At PBMares, our strongest motivation is to help our clients create the future they envision for themselves and their families.

As an independent registered investment advisory firm, our fiduciary standard of care guides us to make decisions in your best interest. Our evidence-based approach is informed by academic research. This enables us to properly diversify your assets, while considering expenses and tax considerations, and ultimately support your objectives for the future.

Let us become part of your financial team. Our driving philosophy is to do what is best for you, your family, and your future.

Contact us today.

The information contained in this article is for informational purposes only, and cannot be relied upon for legal, financial, tax, or accounting advice. Be sure to consult with your financial advisor on this topic as individual situations may vary. Any specific questions you may have can be sent to us by email and we would be happy to assist you.

Sources

1. Fidelity Investments. (2024, August 8). Fidelity Investments® Releases 2024 Retiree Health Care Cost Estimate as Americans Seek Clarity Around Medicare Selection. Fidelity Investments. https://newsroom.fidelity.com/pressreleases/fidelity-investments–releases-2024-retiree-health-care-cost-estimate-as-americans-seek-clarity-arou/s/7322cc17-0b90-46c4-ba49-38d6e91c3961

2. HealthMarkets. (2024, March 14). How much does health insurance cost per month?. HealthMarkets. https://www.healthmarkets.com/resources/health-insurance/health-insurance-cost-per-month/

3. Modglin, L. (2025, April 8). Long-term care statistics 2025. SingleCare. https://www.singlecare.com/blog/news/long-term-care-statistics/

4. Sigel, Z., & Hickman, B. (2025, March 7). Health Savings Account (HSA) Rules and Limits. Investopedia. https://www.investopedia.com/articles/personal-finance/082914/rules-having-health-savings-account-hsa.asp