The IRS isn’t alone in its historic backlog. The global supply chain is also still reeling from pandemic disruptions, and the outlook – at least for 2022 – isn’t good.

What’s the new normal in the global supply chain? There isn’t one.

Supply chain issues have impacted companies large and small. Amazon, for example, experienced stalled growth because of higher supply chain costs and this affected more than half of middle-market companies in one way or another. The state of the global supply chain is even a factor in a downgraded economic growth forecast.

How Did We Get Here?

Early in the pandemic, on top of factory shutdowns, manufacturers forecasted a lower demand for certain goods. As a result, a wide variety of products, like the computer chips used in new cars, cut production. “The pandemic did not eliminate spending so much as shift it around,” said an article in The New York Times. As demand increased, manufacturers were simply unable to meet orders. Even when they did, products remained on container ships.

That was 2020.

In 2021, the Suez Canal blockage and an unexpected deep freeze in Texas put another hold on the global supply chain.

Lean pricing and manufacturing models that produced excellent shareholder returns are falling by the wayside as manufacturers instead opt for more capacity. COVID-19 and ensuing events in 2021 raised the alarm for a more resilient supply chain, one that balances price control and changing demand. The “just in time” manufacturing model may be gone forever.

Today, chip shortages in vehicles are so common that the estimated wait time for some new cars is 18 months. Other vehicles are being delivered without full functionality – a missing rear air conditioning system, for example. Household appliances are seeing similar wait times, and so are many other products. Quick shipping is far from a guarantee.

Now, there is also inflation to deal with. Material prices rose sharply in certain sectors throughout the pandemic, especially in construction, real estate, and manufacturing. With inflation at a 40-year high and rising interest rates, the cost of practically everything will continue to affect the global supply chain.

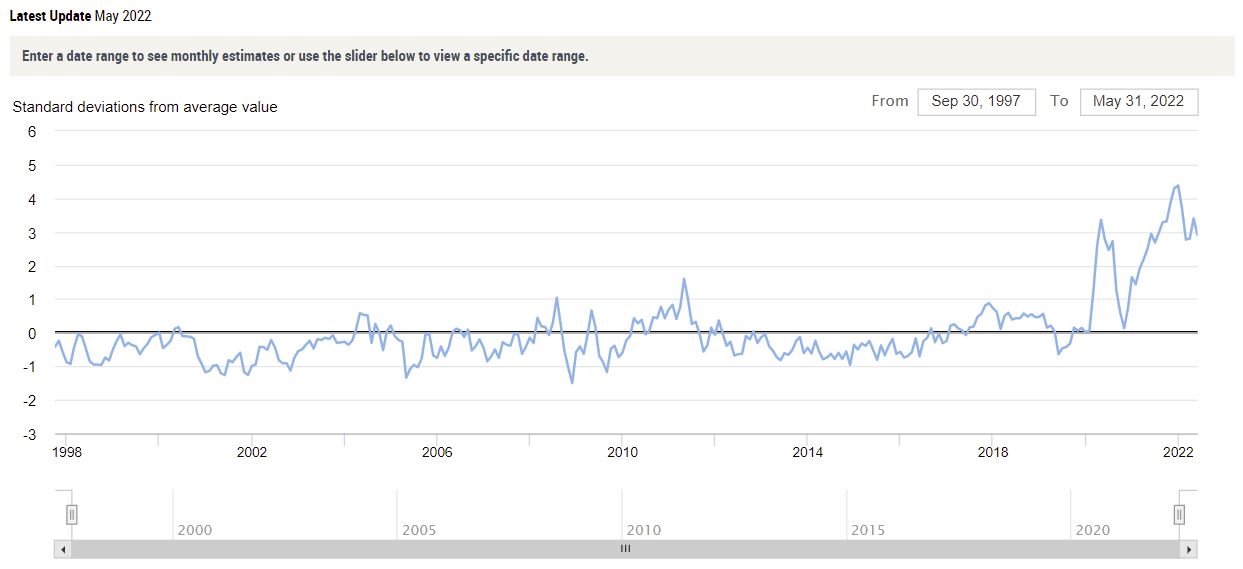

This month, the New York Fed launched its first Global Supply Chain Pressure Index (GSCPI). The research will be published monthly and will measure “the intensity of global supply chain disruptions.” Stakeholders can use this new index to assess supply chain constraints relative to economic conditions and how that data changes over time. The GSCPI will track shifts in supply chain pressures starting from 1997.

“Our index provides one bird’s-eye view of potential disruptions as well as regional indicators for analyzing trade, inflation, and globalization trends across the United States, China, Japan, the Euro-area, South Korea, Taiwan, and the United Kingdom,” said Jan Groen, Economic Research Advisor with the Fed.

Other Factors

Ports are still backed up. Boats are being turned away and being asked to wait for days or weeks at a time until ports have the space to offload goods. The average wait time to unload container ships in the first quarter of 2022 was seven days – higher than when the U.S. was in the middle of COVID-19.

There is optimism there, however; data from the U.S. Department of Transportation (USDOT) revealed that since February, the total number of container ships waiting at U.S. ports dropped by almost 50 percent. Using the same timeframe, the U.S. has imported 260,000 more containers, an increase of 12 percent.

The labor market is also still tight. Worker shortages are being felt everywhere, from manufacturing plants to suppliers and even truck drivers. Even when companies have increased pay, they face an uphill battle filling open positions. The trucking industry, for example, is short by about 80,000 positions. Construction is in dire need of workers as well.

Then there’s the rise of e-commerce. Already trending higher before COVID-19, the pandemic accelerated the shop-at-home trend. Instead of shipping products from factories to central warehouses, destinations are now homes and businesses.

Outdated technology isn’t helping. The lack of a real-time, data-informed software has made it hard for shipping companies to accurately forecast growth or spot problems quickly.

All of these are pervasive issues that involve every step of the supply chain and have for years. The biggest difference is that the pandemic exposed all of them, all at once. Catching up will take time and money.

Supply Chain Impacts to the Construction Industry

Ongoing supply chain issues are a contributing factor to flat growth forecasts in 2022. Yet, other areas, mainly in infrastructure, industrial, and healthcare, are forecasted for double-digit growth compared to 2020.

Material shortages combined with higher prices will make continued growth and profitability harder. It’s estimated that volatile pricing will remain for now and existing supplies are at risk in certain climates; one article pointed out the deep freeze in Texas last year as an example. The record cold temperatures stopped resin production, which made certain plastics widely unavailable. Furniture stores also experience delays due to the February 2021 Texas freeze that caused shortages in chemical components of foam.

Some industry experts are saying that even if the supply chain issues are fixed, that still won’t solve a labor shortage issue. The Infrastructure Investment and Jobs Act is cause for optimism, but more jobs also means that more labor and materials will be needed. While the legislation is boosting profitability expectations, it also raises concerns for the availability and cost of skilled labor and materials.

Many contractors have found short-term success in stretching out their job timelines and passing on some of the burden of finding materials to the project owner. Working with an existing supplier relationship has also been effective.

Possible Solutions

It isn’t as much a question of fixing the supply chain; instead, solutions lie in its evolution. Meeting changing consumer demand in a more complicated, uncertain market won’t be easy or cheap. Policymakers face formidable challenges with aging infrastructure, sociopolitical tensions, and ongoing COVID surges.

One solution has been capacity. Larger retailers, for example, are increasing their warehouse’s physical footprints. Prime examples can be seen in Amazon and Lowe’s; they spent $164 million and $17 million last year, respectively, on new warehouse space.

Automated technology will help better manage inventory, both on-hand and the projected future demand for it. Cloud software can improve workflow, forecast supply and demand, and identify trends and patterns. Many companies that already have advanced tech dashboards in place probably aren’t using them to their full advantage. Using technology better means achieving a balance between supply and demand, cost and profit, and real-time risk management.

What KPMG calls supply-aware dynamic pricing (SADP) is another way to use smarter technology in these uncertain scenarios. In a new report, KPMG describes SADP as automatically adjusting SKU prices monthly, weekly, or daily based on data analytics. Dynamic pricing can already be seen with Uber or Lyft; in peak demand times, the price for a rideshare goes up. Hospitality and travel also use dynamic pricing. “Our research shows that companies that have mature pricing practices have been able to raise EBITDA margins by 3 to 8 percentage points above those of their peers,” a KPMG study reported.

Repurposed physical space, like for retailers that may have closed some brick-and-mortar locations, can also be a solution for some companies that need overflow storage space.

And yet, many executives aren’t taking long-term approaches. Instead, short-term measures are being taken to ease supply chain issues.

Moving Forward

There are many ways the future can go, and no one has a crystal ball accurate enough to predict it. The best approach will vary from one company to another. Generally, though, companies across all industries can benefit from a more resilient supply chain, upgraded technology, and more proactive forecasting.

That’s where having a team of knowledgeable, informed advisors comes in. No one can predict the future, but leaders can use better financial modeling and market analysis to inform their decisions.

Contact your PBMares representative to find out the solutions we offer for forward-thinking business advisory services.