What’s New:

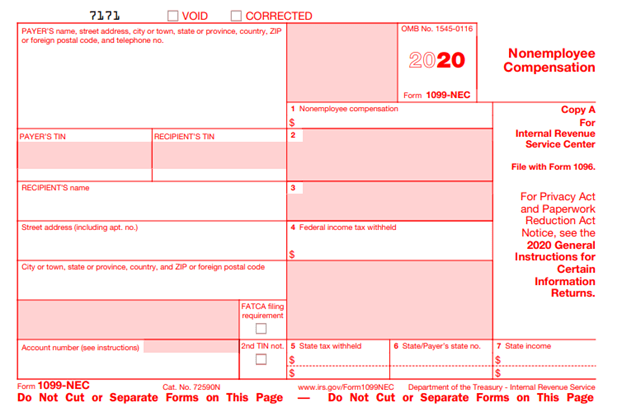

NEW FORM 1099-NEC: The PATH Act accelerated the due date for filing Form 1099 that included nonemployee compensation (NEC) to January 31, and Treasury Regulations eliminated the automatic 30-day extension of time to file for forms that included NEC. To avoid additional burden on filers to separately report NEC by January 31, and other payments by February 28 (by March 31 if filing electronically, we (IRS)sic have created new a Form 1099-NEC. Use Form 1099-NEC to report nonemployee compensation and file by February 1, 2021 with the IRS.

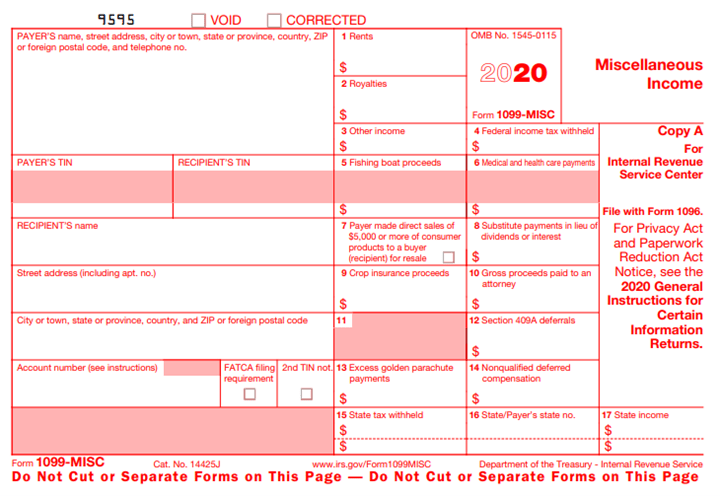

Historically Form 1099-MISC was used to report non-employee compensation (NEC) along with other items such as Rents, Royalties, Prizes and awards, Damages, etc. The filing dates were January 31st to the recipient and February 28th to IRS. If forms are filed electronically, the IRS filing date was March 31st. There was an extension available for filing with the IRS.

Effective for filing of 2019 forms, the due date for filing Form 1099-MISC with amounts for NEC with the IRS was changed to January 31st. Rather than filing one set of Form 1099-MISC with NEC and another set of Form 1099-MISC for all other items, many taxpayers filed 1099-MISC with both types of income together.

Apparently, the IRS realized that this added to the taxpayer’s burden for filing 1099’s. Effective for the 2020 Filing of information returns, there is a new Form 1099-NEC. This form will only be used to report non-employee compensation and will be due to the recipient and IRS by January 31st or the next business day. There is NO extension available for Form 1099-NEC.

The 2020 Form 1099-MISC has been changed to remove the NEC box. A box was added for “nonqualified deferred compensation” and is related to Section 409A. Please see the 2020 Instructions for Form 1099-MISC and 1099-NEC if you have this situation.

This form is due to the recipient by January 31st or the next business day. The form is due to the IRS by February 28th or the next business day if paper-filed. If filing electronically, the due date is March 31st or the next business day. There is an automatic 30-day extension to file with the IRS available by filing Form 8809. The IRS recommends that this form be filed electronically. It can be filed through the FIRE system the same as the Form 1099-MISC.