When it comes to charitable donations, cash might be king, but in-kind contributions play a vital role, too. Donated services and tangible or intangible goods can be sources of revenue and cost savings. Problems can arise when in-kind donations aren’t properly documented or reported, so the Financial Accounting Standards Board (FASB) is making sure there are standards for presenting and disclosing in-kind gifts.

For annual reporting periods beginning after June 15, 2021, not-for-profits will have new rules for reporting in-kind donations. These rules state that not-for-profits must disclose nonfinancial assets separately in the statement of activities. More transparency combined with standards is intended to help stakeholders see a clearer picture of how organizations are utilizing all donations, not just cash.

This will be a change for many smaller organizations that don’t have the same bandwidth or resources to record and track every type of in-kind transaction.

Background of the Accounting Standards Update (ASU): Not-for-Profit Entities (Topic 958)

Users of financial statements and other stakeholders have noted the lack of transparency related to receipts and usage of nonmonetary contributions nonprofits are receiving. Also, many have raised concerns on how in-kind contributions are valued and recorded by nonprofit entities.

The following types of gifts apply under the new FASB standard:

Tangible goods, such as vehicles, furniture, food, clothing, equipment, and real estate. Basically, anything that can be resold or utilized for cash.

Intangible goods, such as reduced or free rent, utilities, and transportation costs.

Services, such as publishing, advertising, legal or accounting services, and catering. These types of services directly or indirectly support the organization’s mission and often lower program costs. Donors can be individuals or any type of entity.

Changes to Not-for-Profit Reporting

The main provisions of the standard require not-for-profit organizations to:

- Present in-kind contributions as a separate line item in the statement of activities separate from cash contributions or other financial assets.

- Disclose policies (if any) on using and monetizing in-kind contributions.

- Disclose in-kind contributions disaggregated by category to show the type of donation.

- Describe any donor restrictions.

- Indicate valuation techniques and inputs used in determining fair value at initial recognition.

- Principal or most advantageous market used to record the fair value only if prohibited by the donor to use or sell the contributed nonfinancial asset.

There is one significant change from the original exposure draft of the guidance. When the FASB board met on June 10, 2020, they agreed that disclosing intent to use or monetize an in-kind donation would not be required.

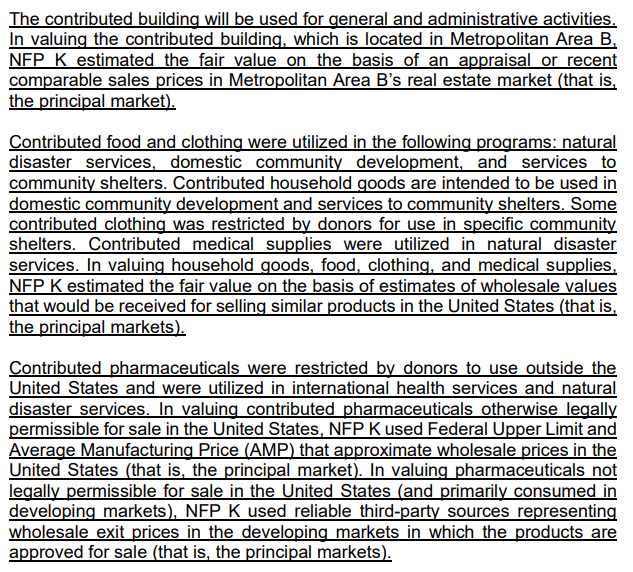

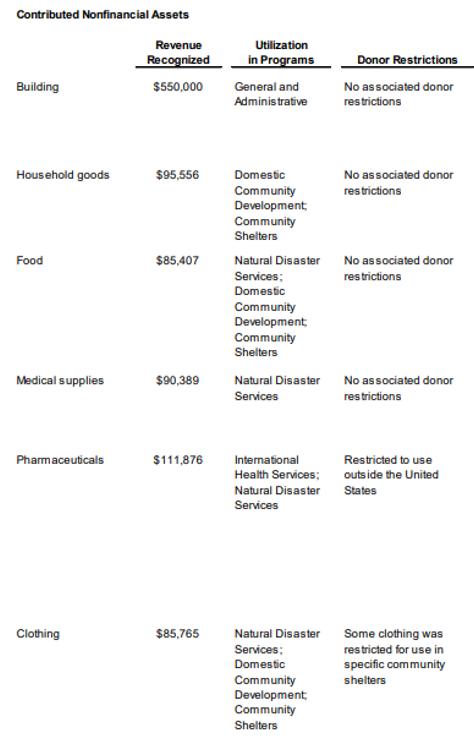

The ASU does not specify how disclosures should be presented. The organization should evaluate its own reporting model and decide on a consistent approach that meets FASB’s requirements. Here are two examples of disclosures from FASB’s original draft proposal; the first example is in paragraph form and the second example is tabular. These examples are likely to be updated with the release of the final ASU.

Example 1: pp. 10-11 of FASB Exposure Draft issued February 10, 2020

In the above example, under the revised guidance, the principal markets would only need to be disclosed if the donor prohibited the use or sale of the contributed nonfinancial asset.

Example 2: p. 12 of FASB Exposure Draft issued February 10, 2020

This example doesn’t note the required valuation inputs or methods used at initial recognition. Neither example discloses a policy (if any) on using and monetizing in-kind contributions.

You can read the full project update on FASB’s website.

It is important to note that while these changes will take effect for annual reporting periods beginning after June 15, 2021, there is currently no deviation from reporting guidelines on Form 990. Organizations should continue to report tangible in-kind gifts as follows:

- Gifts of property: reported as grants, contributions, or membership fees

- Gifts more than $25,000: submit extra paperwork

- Gifts of art or artifacts: submit extra paperwork

- Gifts of services: not required to be reported; value instead shown as reconciling items

Best Practices

It’s worth noting that this update does not create new reporting and measurement requirements. Instead, FASB simply seeks to improve presentation and disclosure requirements. Organizations that need to refine their disclosure process should start with the chart of accounts, then turn attention to creating a policy for monetizing in-kind donations that are not utilized at the end of a reporting period.

In the chart of accounts, make sure there are separate categories to record in-kind contributions. For example, it would be best to have separate in-kind revenue accounts set up for each category of contributed non-financial assets.

A policy on monetizing in-kind donations can include the following stipulations:

- Setting a threshold for de minimis

- Defining the basis for valuing the in-kind donation.

- Ensuring adequate internal controls for recording, reviewing, and tracking the in-kind donations, and documenting them in the policy.

Other best practices for enhancing the way that in-kind contributions are recorded include developing:

- Gift agreements

- Useful for large donations and/or specific or complex donation requests

- In-Kind Forms

- An online or paper form designed to ease reporting requirements

- Gift acknowledgement forms

- Useful to speed up acknowledging gifts more than $250 in value

None of these forms is considered legally binding, but they do go a long way in documenting details and setting expectations between the donor and the organization.

Implementation Timeline

- November 2019: FASB discusses the scope, presentations, and disclosures of in-kind gifts

- February 2020: Initial proposal published; public comments due by April 2020

- June 10, 2020: Amendments to the ASU were released

- Third Quarter: Final standard to be published

- Fiscal years beginning after June 15, 2021: ASU takes effect

Properly accounting for in-kind donations helps organizations and their stakeholders clearly understand how these types of gifts impact programs and services. Some smaller organizations that rely on in-kind contributions may be underreporting, and that’s part of the reason why FASB issued this new guidance in the first place.

If your organization has questions on how to implement new rules for reporting in-kind donations, contact Bo Garner, CPA, MBA, Team Leader for PBMares’ Not-for-Profit group.