Source: RSM US LLP.

ARTICLE

Executive summary

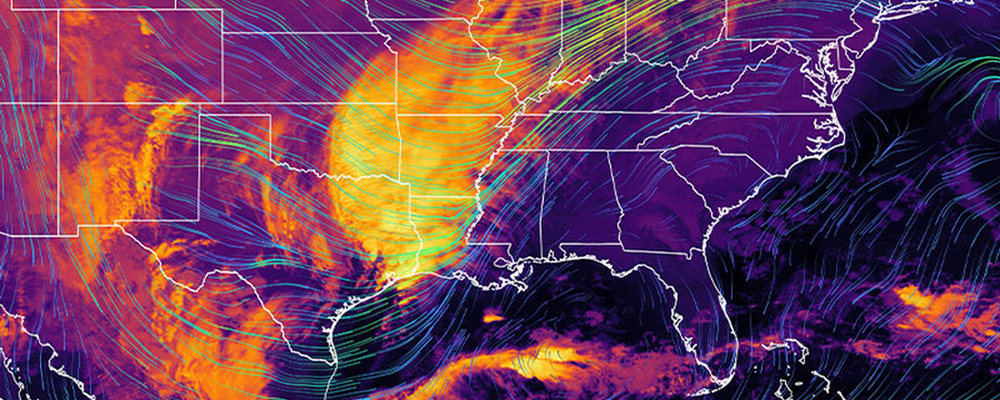

Recent disasters, including Hurricanes Helene and Milton, have prompted many organizations and individuals to explore ways to provide support to members of the impacted communities. While businesses can provide assistance directly to their own employees impacted by a qualified disaster (under limitations discussed below), providing assistance through a new or existing tax-exempt charitable organization can offer added benefits, including charitable contribution deductions for donors and the ability to consolidate and streamline response efforts for maximum impact.

Qualified Disasters

A “qualified disaster” is typically a federally declared disaster found on the Federal Emergency Management Agency (FEMA) website. Qualified disaster relief payments are excluded from the recipient’s taxable income and are not subject to employment tax. These include payments from any source (including charities, private foundations, employers, and related organizations) if made for the following reasonable and necessary expenses incurred because of a qualified disaster:

- Personal, family, living, or funeral expenses;

- Expenses incurred for the repair or rehabilitation of a personal residence; or

- Expenses incurred for the repair or replacement of the contents of a personal residence.

However, qualified disaster relief payments do not include payments for expenses otherwise paid for by insurance or other reimbursements, or income replacement payments, such as payments of lost wages, lost business income or unemployment compensation.

Types of Assistance

Charitable organizations, including public charities, private foundations and donor advised funds, may provide financial or in-kind assistance to individuals and businesses in the event of a qualified disaster. IRS Pub. 3833, Disaster Relief, provides practical and helpful guidelines for such assistance.

Individual assistance could include basic necessities like food, clothing, housing, transportation, or medical care. Whether the aid is appropriate depends upon the recipient’s needs and resources. Immediate relief may be necessary in the event of an emergency, regardless of one’s financial resources. For example, by providing people with food and supplies in the immediate aftermath of a hurricane. Longer-term assistance may be rendered to individuals that have a demonstrable financial need or distress.

Assistance to businesses is permissible if doing so is a reasonable means of accomplishing the charitable organization’s exempt purpose and any private benefit is incidental to the accomplishment of that purpose.

Employer-sponsored Assistance Programs

The following table summarizes the different options available to businesses, employees, vendors, and other third parties to contribute to an employee relief fund while meeting the following objectives:

- Excluding the assistance from the employee’s taxable income,

- Providing the donor with a charitable contribution deduction, and

- Excluding the contributions from the company’s income.

|

Type |

Comments |

|

Employer-sponsored public charity A section 501(c)(3) organization that generally receives its support from contributions from employees and other third parties. If one or more related persons (including companies) provide too much support over a rolling five-year period, the organization may not qualify as a public charity. |

· The employer must not exercise “excessive control.” · Typically, rank and file employees constitute a significant portion of the board. · Independent selection committee or adequate substitute procedures. |

|

Employer-sponsored private foundation |

· Independent selection committee or adequate substitute procedures. · No payment to directors, officers, or trustees of the foundation or members of the selection committee or any family members. |

|

Employer-sponsored donor advised fund (DAF) A fund or account maintained by a section 501(c)(3) public charity made with reference to the donor over which the donor (or a person appointed by the donor) has or expects to have advisory privileges over the distribution or investment of amounts in the account. |

· No payment for the benefit of the selection committee. · Independent selection committee or adequate substitute procedures. |

|

Unrelated public charity There are existing section 501(c)(3) organizations that operate employee assistance programs as their business. These funds permit and encourage employee giving while offering the employer broad discretion in the types of hardships covered by the program. |

· Removes all administrative burden. · Third-party has experience and expertise in operating these programs. · Employer has less control. · Possible risk that it can or will be treated as a DAF in the future. |

This article was written by Lauren Nowakowski, Morgan Souza, Alexandra O. Mitchell and originally appeared on 2024-10-11. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/tax-alerts/2024/qualified-disaster-relief-through-charitable-organizations.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.