When talking about fraud, one question always bubbles under the surface:

“Whose job is it to stop fraud?”

Then the conversation goes something like:

- Ask the board? It’s the compliance team.

- Ask compliance? It’s the fraud team members.

- Ask the fraud team members? That’s a tech problem.

- Ask tech? That’s a policy issue.

- Ask the customer? They want their money back.

And just like that, a fraudster walks in, unnoticed, unchallenged, and unaccounted for.

The Governance Gap Nobody Talks About

At the ACFE Fraud Conference I attended in Nashville this year, many speakers touched on something many of us feel but rarely say out loud: fraud is falling through the cracks because no one owns it, leading to a state of disarray.

In an ideal world, there is a clear leader in fraud risk. This individual is senior, empowered, strategic, and accountable. They sit high enough to make decisions, have the clout to get things done, and stay focused on the big picture. They’re not borrowed from another department or filling in “for now.” Instead, they stand shoulder to shoulder with legal, cyber, and compliance leaders—setting strategy, rolling out controls, and tracking results so fraud is managed every day, not just cleaned up after the fact.

But let’s be honest, in most organizations, fraud lives in fragments:

- Fraud staff buried in alerts, trying to separate real threats from false alarms

- Compliance teams are stretched thin across regulations, audits, and risk reviews

- IT teams are rushing to plug holes and prevent the subsequent breach

- Governance groups reviewing policies once a year and calling it a day

When the responsibility for fraud is fragmented, no one really owns it, and that is precisely when fraud gets through. And that is where the real risk lies.

What Happens When There Is No Clear Ownership?

- Controls go untested because no one owns the strategy

- Vendors get deployed without ROI reviews or integration plans

- Fraud losses rise, but reporting stays buried in siloed dashboards

- The fraudsters learn your system faster than you do

Most companies never invest in a role that owns a fraud strategy. Not just operations. Not just analytics. Strategy.

Fighting fraud reactively is like playing defense with your eyes closed. The following is what we should be asking to have a fraud strategy:

- Are we utilizing our fraud data effectively to inform decisions?

- Do we have the right fraud partners?

- Is our fraud appetite aligned with our customers’ tolerance for friction?

- Are we staying ahead of what fraud could look like tomorrow?

This is leadership. And it is often missing.

Why It Matters More Than Ever

With generative AI, deepfakes, and synthetic IDs scaling like startups, your fraud risk landscape isn’t just evolving, it is accelerating. Meanwhile, governance structures are still built for last year’s threats. If your organization’s fraud governance model involves quarterly updates and annual reviews, you may well just be exposed.

This is not just a finance or compliance problem.

It is an enterprise risk issue.

It is a reputational risk issue.

And for government contractors, it could become a debarment-level risk.

This means that:

- Governance needs to evolve beyond annual reviews

- Fraud risk must be represented at the table with compliance, security, and product

- You need a structure that’s agile, cross-functional, and empowered to act fast

- Because stopping fraud isn’t just about controls.

- It is about who sees the entire chessboard and who gets to move the pieces.

Key Takeaway

If you’re unsure who owns the fraud risk in your organization, the answer is likely that no one does.

Start there.

- Define it.

- Structure it.

- Empower it.

Because fraud does not wait for org charts to catch up.

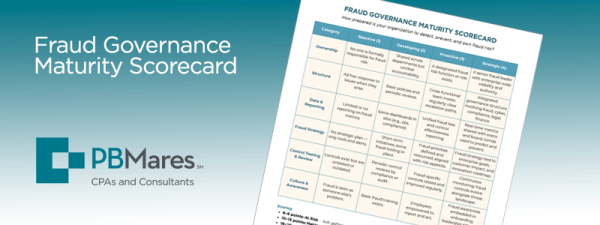

Introducing the Fraud Governance Maturity Scorecard

One of the most overlooked questions in enterprise risk management is also one of the most important:

“How mature is your organization’s approach to fraud governance?”

Many companies focus on fraud detection after it has occurred, investing in tools, alerts, and incident response.

Fewer organizations take the time to ask whether they’ve built the proper structure, ownership, and strategy to prevent fraud in the first place.

And in today’s world, reactive isn’t good enough.

Free Download

To help government contractors assess their posture, we have created the Fraud Governance Maturity Scorecard —a simple framework to identify where your organization stands and what steps you can take to improve.

Fill out the form below to access the scorecard.