By Ryan Paul, CPA

Keep reading to understand:

The commercial real estate (CRE) landscape is currently facing a significant challenge: a looming $1.5 trillion debt bubble. Observers in the industry have expressed concerns about the potential for an economic downturn reminiscent of the 2008 financial crisis, with potential risks

including bank failures, widespread defaults, and declining property valuations. While there is a sense of caution, it’s important to acknowledge that real estate values have historically exhibited variability. To successfully navigate the up and down market ahead, investors will need to anticipate change and pivot when circumstances require it.

The Maturity Wall

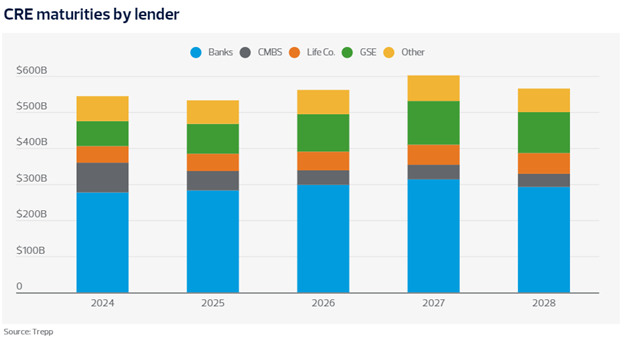

At the heart of the current challenges facing the CRE sector lies the “front-loaded” maturity wall, where $1.5 trillion in debt is poised to mature by the end of 2025. This upcoming deadline underscores the urgency for stakeholders to devise and implement strategies aimed at mitigating risks and successfully navigating through the impending financial squeeze. The maturity wall represents a pivotal moment for the sector’s immediate future and sets the stage for its trajectory in the years to come.

The impending maturity wall is compounded by various factors contributing to increased costs and financial instability within the industry. Elevated interest rates, alongside a significant rise in labor costs, have driven up borrowing expenses and operational expenditures for real estate projects. Moreover, the escalation of property insurance premiums, particularly evident in multifamily, office, and retail properties, further adds to the financial burden faced by property owners and investors.

However, there is a glimmer of hope on the horizon. U.S. Federal Reserve Chairman Jerome Powell has indicated that interest rates are expected to drop in 2024. This potential shift in policy could alleviate some of the financial pressures facing the CRE sector.

Understanding the Debt Bubble

The CRE debt bubble is rooted in a combination of factors, including economic policies, market forces, and unforeseen external shocks. Historically low interest rates prior to the pandemic made borrowing increasingly attractive, leading to a significant accumulation of debt. With interest rates now at a 22-year peak, the cost of refinancing has become cost-prohibitive, complicating efforts to manage existing debt burdens.

Additionally, the failures of Silicon Valley Bank and Signature Bank in 2023 have instilled a sense of caution across the banking sector. This is particularly evident among smaller and regional banks, which are deeply entwined with the CRE market through commercial mortgage-backed securities (CMBS) and direct loans, accounting for nearly 30 percent of office building debt. Notably, 14 percent of all CRE loans are currently in negative equity.

Source: Trepp, RSM US LLP

Sector-Specific Insights

It’s important to recognize that the challenges vary significantly across different sectors. While some experts are warning of a decline in commercial property valuations over the next year, others are taking a more measured approach, calling for detailed portfolio assessments and creative financing options.

Office: With office vacancy rates at 19.6 percent in Q4 2023, stakeholders have recognized and started to act on the need for innovative space utilization strategies. This trend has sparked interest in transforming traditional office spaces into mixed-use developments and coworking spaces, with about 100 office conversion projects currently in progress across major U.S. cities. Additionally, return-to-office mandates are growing in popularity, especially for larger companies.

Retail: The retail sector, despite facing challenges from the rise of e-commerce, has found strength in experiential and convenience-focused shopping experiences. This adaptability suggests potential for reinvestment and redevelopment efforts that cater to evolving consumer preferences, even with possible valuation adjustments in the near future. Markets located in the Sun Belt, including metro North Carolina, are seeing retail space hit record levels with 13 percent less space available than the national average.

Multifamily Housing: This sector remains robust, driven by sustained demand for residential units. Strong market fundamentals persist despite the rising costs associated with borrowing and construction. Increased demand for developing affordable housing projects underscores the need for innovative financing solutions.

Industrial: Benefiting from the e-commerce boom and changes in supply chain management, the industrial sector continues to experience growth. Incentives from regulatory acts like the Inflation Reduction Act continue to encourage this expansion, especially within infrastructure and logistics. Areas like the Port of Virginia have a favorable long-term outlook, largely attributed to onshoring initiatives and its strategic location near high-growth markets in Virginia and North Carolina.

Digital: Data centers have emerged as a core asset class, with a McKinsey & Co. article from early 2023 forecasting a 10 percent annual growth in demand in the U.S. until 2030. This growth is primarily driven by the increasing adoption of cloud computing and the rising market demand for artificial intelligence. Strategic partnerships between the private sector and municipalities are expected to play a pivotal role in fostering mutually beneficial growth in this sector.

Northern Virginia leads as the largest data center market in the U.S., managing 70 percent of global internet traffic. The market boasts an impressively low data center vacancy rate of 0.4 percent, driving a surge in construction projects, which have grown from 15 MW in 2021 to 66.3 MW in 2023, predominantly preleased. Since 2015, colocation-commissioned inventory has seen an annual average growth rate of 29.9 percent.

Despite the overall success of data centers in Virginia, specific projects may face challenges or opposition from local authorities, as evidenced by the recent recommendation to deny the PW Digital Gateway project by the Prince William County Planning Commission. Both QTS and Compass had master plans encompassing over 11 million square feet for this development.

Mitigating Risks and Seizing Opportunities

As noted, the $1.5 trillion CRE debt bubble presents stakeholders with both significant challenges and unique opportunities. Innovative, strategic, and adaptable approaches are essential to mitigate risks and also capitalize on emerging prospects for growth and stability.

Market instability calls for creative investment strategies

Capital Availability and Strategic Investment: The CRE sector is witnessing a significant availability of “dry powder” or unallocated capital, reaching record highs of $300 billion at the end of 2023. This capital reserve is a critical asset, offering stakeholders the flexibility to seize emerging opportunities as the market adjusts. Strategic investments can be directed towards areas showing potential for growth or in need of revitalization.

Adaptive Reuse and Property Flexibility: The trend towards converting office spaces into multifamily housing or mixed-use developments represents a proactive response to the evolving demands of the market. This approach can help revitalize underutilized properties while also meeting the growing need for residential and community-focused spaces. Additionally, zoning reforms can further facilitate this adaptation, allowing properties to be repurposed more flexibly and effectively in response to changing economic conditions.

Innovative Financing and Operational Efficiency: The market’s readiness for re-pricing efforts and the exploration of alternative financing solutions are crucial for effectively navigating the debt maturity wall. Addressing issues such as negative equity and loan restructuring is imperative for maintaining operations and protecting investments. Furthermore, the adoption of novel solutions, including proptech, can significantly enhance decision-making processes and operational efficiency for both investors and property owners.

Tax Structuring for Capital Generation: For investors exploring creative avenues to capitalize on industry disruptions and generate capital, tax structuring emerges as a key consideration. This involves the strategic structuring of investments, such as Real Estate Investment Trusts (REITs), and evaluating after-tax returns to optimize profitability.

Together, these strategies can help stakeholders navigate the immediate challenges posed by the maturity wall and the debt bubble, while also positioning the CRE market to capitalize on emerging opportunities.

The Path Forward

To navigate current CRE challenges successfully, proactive measures are crucial. Stakeholders will want to closely monitor key economic indicators such as inflation and interest rates, as they will significantly influence market conditions in the coming months. For investors and property owners, maintaining awareness and adaptability will be essential for successfully navigating the road ahead.

For more information on the debt bubble and how it may influence your organization’s real estate decisions, contact Ryan Paul, Partner at PBMares’ Construction & Real Estate team.