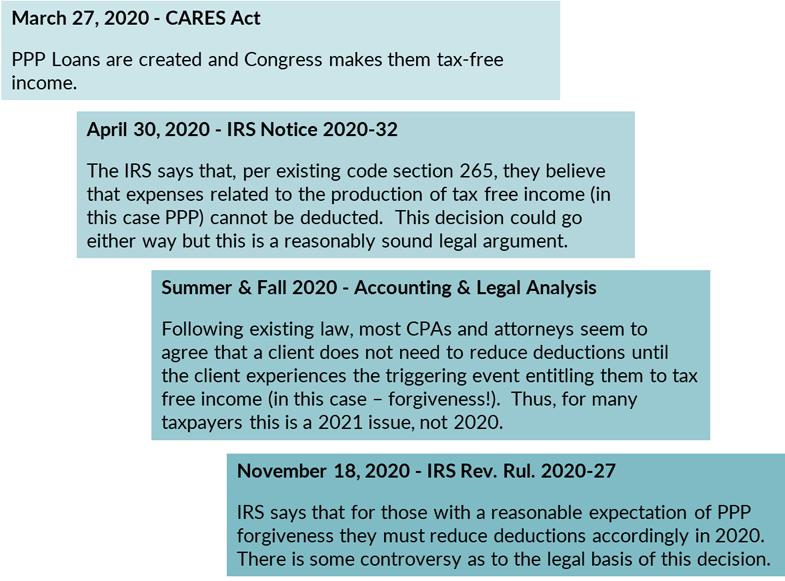

The IRS recently issued guidance that will impact taxable income and tax liabilities for the majority of businesses who received PPP loans. Ultimately the guidance will require businesses to decrease deductions in 2020, thus increasing taxable income and increasing tax liabilities. So where are we? And how did we get here?

We’re sure you have a lot of questions here so we’re going to address a few of the biggest ones here:

Question 1: Whoa! Congress said this would be tax-free. Limiting my deductions by the amount of the PPP has the same effect as treating this as taxable income. What recourse do I have for fighting this?

Answer: We agree that Congressional intent was for this income to truly be tax-free. In fact, there is a Senate bill, S.3612, that would easily correct this by excluding the PPP from this (section 265) treatment. The bill is bipartisan with over 30 co-sponsors. If this bill passes, this would all be moot – the income would be tax-free and all deductions would have their normal tax treatment.

Question 2: So is this bill going to go through?

Answer: We’re not sure. Over the last several months the chances have increased and looks like it is actually approaching a likelihood. But the issue is when? The sooner the better. The bill itself could pass, but it would be much more likely that it will be included in the next COVID stimulus legislation. We’d love it to be before the end of the year but we are really hoping it will be resolved before it’s time to start filing 2020 tax returns.

Question 3: What if I just don’t file for forgiveness until 2021? Will this still apply to me?

Answer: Unfortunately, yes. If forgiveness of the loan is “reasonably expected to occur” the deductions must be limited in 2020. The IRS did provide for two exceptions (though neither are particularly helpful for the average PPP loan) – taxpayers who have their PPP loan application denied and taxpayers who irrevocably decide not to apply for forgiveness.

Question 4: You said the legal basis for this latest IRS guidance is questionable. Do I have to follow it?

Answer: You can opt out of this guidance but to do so you will have to disclose a position relying on a different legal argument. While this is possible this is not a first choice as these types of disclosures often throw up large red flags.

Question 5: How do I know if I have a “reasonable expectation of forgiveness”?

Answer: Unfortunately, the IRS guidance does not explain what would cause a taxpayer to have a “reasonable expectation” that their loan would be forgiven. PBMares and others in the tax community are all looking for guidance in this area, so hopefully more is forthcoming; for the time being, it’s fairly safe to assume the majority of PPP recipients have a reasonable expectation of forgiveness if they have spent the funds as directed by the PPP program and have applied or will apply for forgiveness.

Question 6: I have a PPP loan over $2 million and I am going to have to file Form 3509, the Loan Necessity Questionnaire; do I have a reasonable expectation of forgiveness for the purpose of limited deductions?

Answer: This is one of the few areas where there may be a likelihood of forgiveness but we’re not sure if it meets the “reasonable expectation” threshold (as we stated above that threshold is not defined). The requirement to fill out the 3509 may, in itself, provide enough doubt that the threshold is not met. If you have questions about your loan that is over $2 million, contact your PBMares advisors. Also, stay tuned as we are actively researching this and hope to have more guidance soon.

Question 7: How will this affect my tax planning?

Answer: For clients with significant PPP loans there could be large tax planning implications. It will be more important than ever to work with your PBMares tax advisors to understand the full range of possible outcomes for 2020.

Question 8: What if I think I’m going to achieve full forgiveness and reduce my deductions and then I have a portion not forgiven? Can I go back and claim those deductions?

Answer: Yes, if you expect and file based on the expectation of full forgiveness and ultimately receive something less than full forgiveness you can either amend your 2020 return or include the additional deductions on your 2021 return.

Question 9: What if Congress doesn’t address this before I normally file? Will I need to extend my return?

Answer: If the 116th Congress, currently seated, does not address Section 265 (making this all moot), we will have to look to the 117th Congress, which will be seated in January. If Congress is signaling they will address this issue in legislation, but it will not be finalized by the time you typically file your return, we can help walk you through your options – extension or file and subsequently amend.

Question 10: I’m a Schedule C and I don’t have any wages (just my earnings). Do I need to reduce anything?

Answer: We don’t have guidance on this. A fair application of this would be to have a tax implication for Schedule C filers but how? There are no expenses to reduce if this is just based on a taxpayer’s self-employment earnings. And we’re not going to include it in income as Congress was very clear that PPP income is tax-free.

Question 11: Will this affect my QBI deduction? Or credits associated with wages?

Answer: This is a great question and an area where we are eagerly awaiting guidance – to date we have not received any. There is the potential that this reduction in deductible wages would also reduce the qualifying W-2 wages for purposes of the Qualified Business Income/199A deduction.

Question 12: What Can I do?

Answer: The American Institute of Certified Public Accountants is lobbying on your behalf, but we urge you to call your elected officials to let them know how impactful this will be on your business and your need to have this resolved before you file your return.

Our hope is that Congress acts to make all of this irrelevant, bringing the program back in line with what most perceive as Congressional intent. As that is far from guaranteed, we need to plan given the guidance we have today.

Stay Tuned! We are following this area closely! We will be providing additional information as soon as it is available.

More Questions? Reach out to your PBMares advisors. We’re here to help you.

Don’t miss our upcoming webinar, The Latest on PPP: Forgiveness Application and Legislative Update. Click here to register.