The rapid spread of Covid-19 has sparked a health and economic crisis affecting most industries worldwide. In the hospitality industry, the impact has been particularly sudden and severe. People are abandoning travel and recreation plans and sheltering in place as government officials around the world attempt to “flatten the curve.”

As a result, every sector of the hospitality industry, from restaurants to resorts to private clubs, are adapting to the “new normal” and functioning in ways more conducive to regaining their customers’ trust and business.

While the focus on making customers feel safe will continue for the foreseeable future, the implications for business sustainability and growth in the hospitality industry require immediate action. In other words, businesses need to figure out ways to stay afloat during an economic downturn where no blueprints exist and fast.

The question becomes how to meet financial obligations while dealing with the rapidly expanding social distancing requirements and public safety protocols. In the private club sector, general managers and boards need to make every effort to make data-driven decisions to ensure the financial stability of their clubs.

This means fine-tuning their operating budgets with insights provided by various analytical tools and assessing the potential impact of changing economic conditions caused by the Covid-19 pandemic.

Key metrics such as net new members, member dues, club fees, operating expenses, and debt service obligations must be reassessed under “new normal” assumptions to determine and stress-test a club’s short-term liquidity.

Minimizing Liquidity Risk

As the Covid-19 pandemic unfolds, one of the most immediate threats to most private clubs is liquidity risk – the inability to meet short term obligations. Unlike other industries, businesses in the hospitality sector depend on the continued patronage of members to generate cash flow.

Most private clubs only have a small cash buffer to manage cash fluctuations. And, in private clubs, any change in the collection of member dues and activity fees (e.g. golf) can have a severe impact on the club’s operating budget as these two sources of income tend to cover most fixed operating expenses.

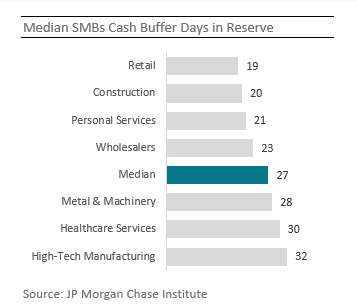

The JP Morgan Institute recently conducted a study that revealed small and mid-sized businesses (SMBs) have a median of 27 days of cash reserves on hand, which means that in the absence of cash flows, they can only pay expenses for less than a month.

Private clubs and golf communities have been hit hard with unexpected operational deficits due to local shelter-in-place orders and the need for social distancing. In fact, event services, most dining rooms, many golf courses, and wellness facilities are closed until further notice. At the same time, clubs are still paying their staff full wages while implementing safety measures that require additional expenses on top of fixed operating expenses.

To minimize the negative financial impact of Covid-19, private clubs need to develop a medium-term liquidity plan to manage the increased risk of experiencing financial distress. The goal is twofold: (1) extend the club’s cash reserves and (2) avoid selling assets below their fair market value.

What Is a Liquidity Plan?

A liquidity management plan is a set of strategies and processes that minimize the risk of not being able to meet short term obligations. Developing such a plan involves conducting a systematic review of the key areas affecting the private club’s cash flows such as member dues, golf fees, staff wages, and other fixed operating expenses. These reviews, in turn, provide the insights needed to make decisions that will accelerate cash inflows, justify cash outflows, and implement operational dashboards with metrics to provide timely feedback on the club’s liquidity position.

At a high level, a comprehensive liquidity management plan has six components:

- 13-week cash flow forecast to get a more granular view on the club’s cash inflows and outflows (along with their underlying assumptions) under different scenarios.

- Accounts receivable management plan to review existing credit policies related to member dues and initiation fees (particularly for new members) and accelerate cash collections.

- Accounts payable management plan to identify critical suppliers and vendors (such as food and beverage) and evaluate how to extend payment terms by negotiating terms and conditions whenever possible.

- Funding options analysis to identify funding alternatives such as adequacy of cash reserves, debt refinancing or additional credit support from banks, or participating in government-sponsored programs such as PPP and EIDL loans.

- Liquidity dashboard to monitor key liquidity metrics such as liquidity ratio, days sales outstanding, days payable outstanding, and interest coverage ratio.

- Liquidity contingency plan to determine specific thresholds and the actions that these thresholds would trigger, such as expense reduction plans, expenditures approvals, and funding mix targets.

At every organization, whether a corporation or a 501c7 private equity country club, cash is the lifeblood of the business. It is a very valuable resource that requires careful management under normal conditions and timely intervention in crisis situations. This requires management to first stabilize the situation by developing a liquidity management plan as outlined above to control the cash bleed, inject much-needed resources, and monitor the situation on a weekly basis. In addition, it is important to include an assessment of how circumstances are likely to play out in the short term. This is where a well-documented cash flow analysis comes into play (as described below).

Anticipating Cash Inflection Points

A good cash flow forecast is one of the most important elements of a liquidity management plan. Making projections about cash inflows and outflows, supported by well-documented assumptions, is a very effective tool in diagnosing possible cash pressures. In turn, this allows management to develop action plans to avoid or mitigate the impact of potential cash shortages. Cash flow forecasts also help to guide business decisions that lead to more efficient operations by optimizing the management of working capital.

An effective cash flow forecast usually involves a rolling 12-month analysis of cash inflows and outflows and consists of three main components: key assumptions, operating projections (income and expenses), and a cash flow model (cash inflows, outflows, and running balance).

In terms of key assumptions, some of the parameters to consider include projections for the next year on a monthly or quarterly basis involving revenue growth, gross margins, operating margins, working capital, capital expenditures, and taxes. In formulating these assumptions, it is also important to develop two scenarios: business as usual and worst case. This provides a more realistic perspective on potential operating outcomes for the organization.

The second component of the cash flow forecast involves translating the assumptions into operating projections. This takes the form of a typical income statement (a.k.a. profit and loss statement) for the next 12 months. Operating projections give club managers and the Board a good idea of how the assumptions play out in each of the two scenarios, while also allowing for adjustments to the assumptions as needed.

The last component involves the cash flow model, which translates the club’s projected operations developed in the income statement into expected cash inflows and cash outflows while keeping a running total of the cash available. It is this running total of the monthly cash balance that will alert potential cash shortages with enough lead time to take corrective action. As managers see the effects of the operating assumptions in the business operating performance and cash balances, look for clues about what specific actions should be taken to avoid or mitigate impending cash flow pressures.

To facilitate the thought process behind the creation of an effective cash flow forecast, here are some important questions to consider:

- What will the economic environment look like for each of the next four quarters?

- What is the likely zero-cash date under the worst-case scenario?

- What fixed costs and expenses (sales, marketing, and general) can be postponed, restructured or optimized?

- What potential sources of capital are available? (e.g. lenders, vendors, investors)

Leveraging What Works

The process of developing a liquidity plan needs to be fluid in the sense that it must respond quickly to changing circumstances. This is not easy, as data collection and analysis rarely happen in real-time, making the planning process more an art than a science. Nevertheless, there are several best practices that will help clubs adapt to changing circumstances and improve their ability to extend cash reserves. Some of these best practices include:

- Focus on short-term (13 weeks) and medium-term forecasting (one year).

- Automate the process as much as possible.

- Analyze forecast vs actual variances to calibrate assumptions.

- Develop a forecast model driven by key metrics and then assign accountability for targets associated with each of those metrics.

- Regularly share cash forecasts and performance information with lenders to encourage their support in lean times.

Finally, it is helpful to think about the future in terms of probabilities and not certainties. This will prompt consideration of different values for the key assumptions driving the liquidity plan. The result will be different possible scenarios. A robust financial analysis including a liquidity management plan and cash flow forecast will increase the club’s resiliency and improve managers’ ability to make informed decisions under difficult conditions.

Navigating the New Normal

The Covid-19 pandemic has accelerated many trends that have been bubbling up for a while in the hospitality industry, while also creating a “new normal.”

In navigating this new territory, make sure to engage with club members and staff on a regular basis. In times of crisis, it is better to over-communicate than to go silent. In fact, there is a simple yet effective three-step communication approach that will help you develop trust with your staff and membership base: (1) communicate what you know, (2) communicate what you don’t know, and (3) communicate when you will provide more information.

Lastly, keep in mind that the primary goal during these turbulent times is to develop a deep understanding of the club’s cash flow requirements in the short and medium-term. This will help the club stay operational until business picks up again and extend cash reserves as much as possible.